The first article in the series on credit focused on the knowledge component of credit. In this article, you’ll put that knowledge into action as you learn the fundamental steps to establishing and building your credit and what impact it has on your future.

How to Establish Credit

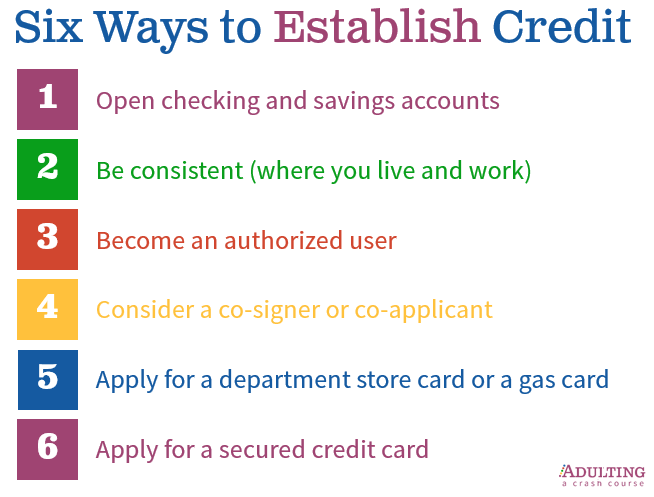

The graphic below depicts six key steps you can take to establish your credit.

Open checking and savings accounts – While these accounts don’t appear on your credit report, they facilitate making timely and full payments to almost all credit types (credit cards, loans, etc.)

Be consistent – lenders are looking for stability, so frequent moves and job changes can make them hesitant to loan to you.

Apply for a department store card or gas card – these tools often are easier to obtain and have lower limits. The catch is that the interest rates can be very high.

Apply for a secured credit card – this type of credit card is similar to most credit cards with one exception – it’s attached to a “collateral” account. Essentially the credit card limit matches the balance of the collateral account. If you demonstrate positive financial habits, the institution will consider moving you to a traditional (unsecured) credit card.

Consider a co-signer or co-applicant – The additional signature and legal obligation will reduce the risk for the credit card company, but if you fail to pay, you can negatively impact your co-signer/co-applicant’s score.

Become an authorized user – Nearly every credit card has the option to add authorized users, who use the same card with the exception of the name on the front. The original applicant is responsible for bill pay, but does establish and build credit for you as an authorized user as well.

How to Build Your Credit

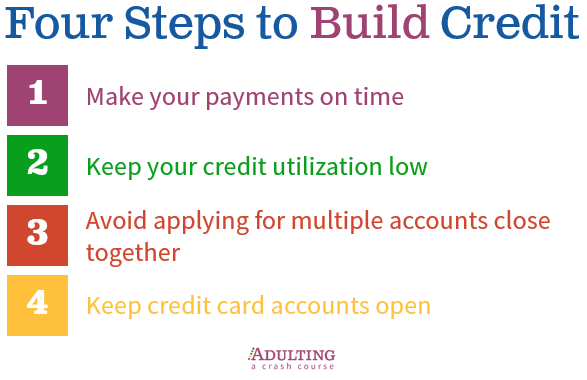

Once you’ve established your credit, building it means taking actions that coordinate with the components. See these four steps described in greater detail below the image.

Make your payments on time – Remember the components of the credit score? The most important component (35%) is payment history so paying your bills on time is the most important step in building credit (and also the best way to avoid late fees and paying too much in interest!)

Keep your credit utilization low – Amounts owed was another key component of the credit score, worth 30%. Institutions define the ideal credit utilization (e.g. amounts owed) as 30%. For example, if you only have one credit card and the limit is $1000, you would keep the balance at or below $300.

Avoid applying for multiple accounts close together – Lenders realize the more accounts you open, the less likely they are to get paid.

Keep credit card accounts open – This action too coincides with the component scale – at 15% of your overall rating, length of credit history is important and so is credit mix at 10%. For accounts to be considered current and active, you want to use them at least twice a year with no more than six months between balances.

The Impact of Your Credit Score

Knowing your current credit score is one thing – understanding the opportunities (or limits) it represents is another. Let’s review who’s concerned about your score:

Banks and other lending institutions

The majority of all credit inquiries come from someone you asked to borrow money from. Whether it be for a car, a house or something as simple as a department store credit card, they all have to understand the risk of loaning you money and the likelihood they will receive repayment in a timely manner.

Not only does your score help them decide if they loan to you, it also determines at what cost. The logic follows that a higher credit score means you are more likely to pay the right amount and at the right time, so you receive a lower interest rate. A lower score means it is a more risky relationship for the lender, so they charge a higher interest rate to ensure they are compensated appropriately.

See the example below to better understand how a credit score can impact a transaction like buying a new car:

You can see that just 81 points meant a difference of almost $7,000! That’s more than $116 every month that the second borrower owes!

Employers

As a part of the background check process, it’s not uncommon for an employer to do a soft credit check on you. They are looking for things like bankruptcies and collections to determine a few things:

- If you are able to manage your responsibilities, including paying your bills

- If you are experiencing financial hardship and therefore may be more likely to steal from them or accept bribes

Landlords

As a part of the apartment application process it is almost guaranteed a landlord will do a soft credit check. They are also looking for a few things:

- How much debt, both in how many lenders and the total dollar amount, do you have. The more of each means the less likely you are to pay them.

- Any past bankruptcies or history of collections. Again, history tends to repeat itself so if you’ve had trouble paying an entity back in the past, you are more likely to have that trouble again.

What’s Next?

Now that you understand the fundamentals of credit and how to take action, it’s time to do it! You’ve been empowered with all of the information and necessary steps to either establish or build credit, so there’s no reason to wait. Even a small amount of focus on this aspect of your personal finances can mean the difference of thousands of dollars!

Are you ready to tackle all of your money challenges?

Check out our Personal Finance course, which includes easy and practical steps to manage your credit, build a budget, understand filing your taxes and more!

Click on the button below to get started today!