Your credit doesn’t just influence how much a bank or lender charges you for a loan – it also can influence an employer’s decision to hire you or a landlord’s decision to let you move in. This article is the the first in a two part series that will empower you with the knowledge and skills to understand and leverage your credit score.

This article in particular is focused on the knowledge element, specifically:

- Key terminology

- Types of credit scores

- Credit score components

- Credit score ranges

Key Terminology

Understanding a few of the key terms is a critical first step in understanding credit as a whole. The four items below are of particular importance:

Credit – Merriam-Webster Dictionary defines credit as the provision [loan] of money, goods, or services with the expectation of future payment.

Credit score – A rating that indicates a person or entity’s ability to repay a loan.

Soft credit pull/inquiry- when a party reviews part, but not all, of a person’s credit history; a soft credit check does not impact the debtor’s score. As the debtor, you have access (and are encouraged) to check your score as often as you deem necessary.

Hard credit pull/inquiry – when a party reviews your complete credit report. This pull does reduce your score and therefore requires your consent. This level of pull is almost exclusively used when you pursue a new line of credit (such as a loan, mortgage or credit card).

Collections – When a debtor fails to make payments for a specified amount of time (often 180 days), the lender will sell the debt to a third party, often known as a collection agency, who then attempts to get as much of the debt payment as possible.

Types of Credit Scores

There are a two prominent organizations that assign credit scores, namely:

FICO – The most widely recognized credit score, FICO stands for Fair Isaac Company. According to their website, more than 90% of the top lenders use the FICO credit score when making decisions. FICO also has six categories of scores, ranging from

Vantage – Created in 2006 by the three major credit bureaus (Experian, Equifax and TransUnion) to provide competition and an alternative score versus FICO.

Due to its popularity, this article focuses on the FICO credit scoring model.

The Components

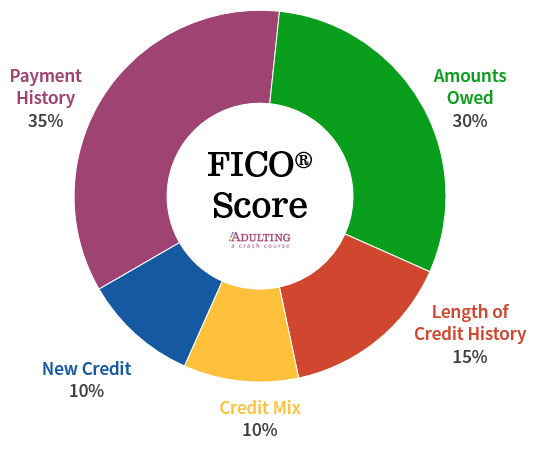

Your FICO credit score is a combination of five key components but as indicated in the image below, not all five are weighted evenly,

Payment history – this component has the highest weight because past behavior is the greatest indicator of future behavior.

Amounts owed – sometimes called “credit utilization”, a lending institution will evaluate how much credit you have available to you and how much of it you utilize at any given time. The ideal is to utilize 30% of your available credit.

For example, you have only two credit cards that each have a credit limit of $500, meaning you have $1000 in available credit. The ideal combined balance (credit utilized) between the two is approximately $300.

Length of credit history – this component plays nicely with the payment history component. Being consistent is one thing, but the longer you have been consistent the more likely you will continue to be. This is why it is discouraged to close credit card accounts. Even if it is a card you rarely use, it’s recommended at least twice a year you charge to that card and pay it off in full on the next billing cycle.

Credit mix – having more than one credit card is a positive for your credit score, but the addition of other credit types such as auto loan, personal loan or mortgage demonstrates your ability to manage a variety of debt types.

New credit – opening a new line of credit of any type will temporarily reduce your credit score but can, in the long run, improve it (because it will enhance the data for the other four components). As a benchmark, try to wait at least six months between new account openings.

Credit Score Ranges

As a reminder, a credit score indicates to a lender how likely you are to repay a loan. Credit scores can range from 300-850.

The higher the score, the more likely you are to be approved for a line of credit or loan and the lower your interest rate will be.

For example, refinancing student loans is rarely even an option with a credit score of less than 650. It’s important to not only always know your current credit score, but also have plans to improve it.

In Conclusion

Understanding the key terms, score types, components and ranking of your credit score is just the beginning of your credit history (and, more importantly, future). Now that you understand its purpose, I encourage you to read our partner article where you will develop the skills to establish, build and improve your credit score.